Table of Contents

Netflix Warner Bros Discovery Merger, Paramount Hostile Takeover

Netflix Warner Bros Discovery Merger, Paramount Hostile Takeover: The end of 2025 has brought a period of monumental upheaval across the media, entertainment, and technology sectors, headlined by a fierce corporate acquisition battle that promises to reshape global streaming forever. Netflix’s planned acquisition of Warner Bros. Discovery’s studio and streaming assets—including the coveted HBO and HBO Max—has dominated headlines, not only for its sheer size but also for the ferocious resistance it faced from rival giant Paramount.

While the streaming industry prepares for a new era of consolidation and regulatory oversight, parallel shifts in Big Tech, specifically the high-profile executive departures at Apple and a public misstep in AI-driven advertising by McDonald’s, underscore a volatile business environment where innovation and market power are fiercely contested.

The Hostile Battle for Hollywood Royalty: Netflix Edges Out Paramount

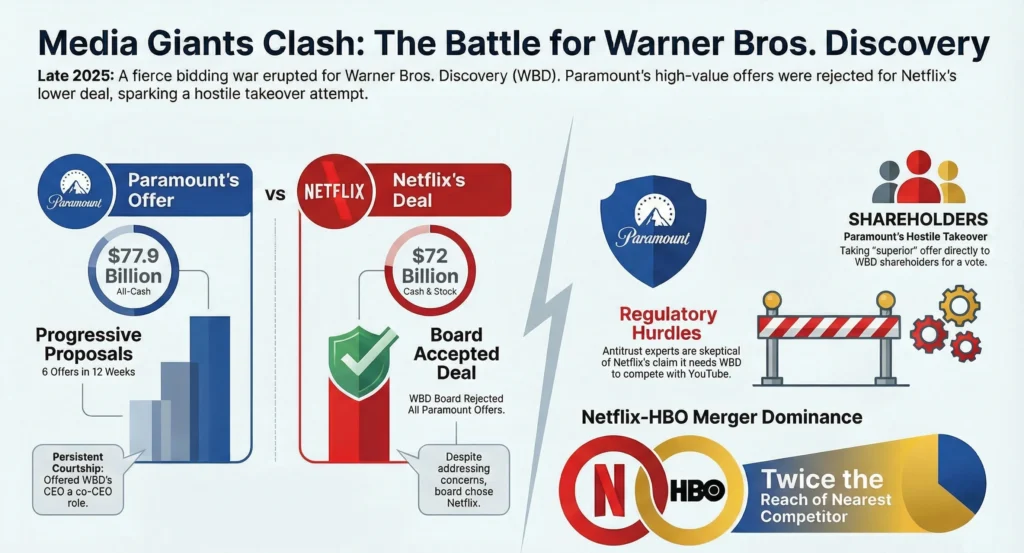

The deal, valued at 72billion(27.75 per share, total equity value of $72 billion) for Warner Bros. Discovery’s studios and streaming unit, saw Netflix successfully secure one of the most iconic content libraries in Hollywood. This victory was achieved despite an aggressive, months-long pursuit by David Ellison and Paramount Skydance, who ultimately lost the prize and responded by launching a hostile takeover bid directly to Warner Bros. Discovery (WBD) shareholders.

Paramount’s Intense Courtship and Rejected Offers

David Ellison courted WBD CEO David Zaslav intensely over 12 weeks, including hosting him for dinner with his father, Larry Ellison, and meeting at Zaslav’s Beverly Hills home to discuss a potential combination. Paramount Skydance submitted six proposals to the WBD board, consistently arguing the “industrial logic” of merging the two companies.

Paramount’s efforts culminated in a superior, all-cash offer of $30 per share, representing an equity value of $77.9 billion. This final offer, submitted on December 4, 2025, was not subject to any financing condition and included signed committed debt financing and equity backstops from principal equity holders. Furthermore, Paramount offered Zaslav the roles of co-CEO and co-chairman of the combined company.

Despite the clear financial superiority of Paramount’s final all-cash bid, which included fully executable agreements and fully committed financing, the WBD Board chose to commit to the Netflix agreement, deemed financially inferior at $27.75 per share. Ellison’s final texts to Zaslav regarding the improved bid went unanswered.

Regulatory Certainty and Foreign Investment Concerns

One key area of distinction between the bids involved regulatory certainty and financing structure. Paramount’s offers included significant protections for WBD shareholders, such as raising the proposed regulatory reverse termination fee to as high as $5 billion. Paramount also committed to taking actions to achieve regulatory clearance, indicating confidence in their ability to gain approval.

However, the WBD Board expressed concerns over Paramount’s equity financing structure, particularly the presence of non-U.S. funding sources, including three sovereign wealth funds from the Middle East ($24 billion commitment) and Jared Kushner’s Affinity Partners. Warner Bros. Discovery was reportedly keen to avoid review by the Committee on Foreign Investment in the United States (CFIUS). Paramount restructured its final $30/share bid, removing Chinese internet company Tencent as a financing partner and ensuring the sovereign wealth funds agreed to forgo any governance rights (like board representation) to negate the need for a CFIUS review.

Ultimately, the WBD board rejected every proposal from Paramount, announcing the deal with Netflix on December 5, 2025. In response, Paramount Skydance immediately commenced a hostile takeover bid, taking its case directly to WBD shareholders whom Ellison argued “deserve transparency and the ability to make an informed decision”.

Antitrust Tightrope: Netflix’s Contentious YouTube Rivalry Claim

The $72 billion merger, which would create a combined entity with 428 million subscribers globally, immediately attracted high scrutiny from competition authorities in the US and Europe due to the sheer scale of consolidation.

In defending the deal, Netflix has deployed a strategy often used by merging companies: pointing to competition from a broad universe of players. Netflix insists the acquisition is necessary to compete with Alphabet’s YouTube, which media analysis firm Nielsen ranks as America’s most-watched TV distributor. The core argument is based on the idea that people only watch a “certain amount of content a day,” suggesting finite consumer time makes YouTube a substitutable rival.

Why Regulators Are Skeptical

Antitrust experts, including former DOJ attorneys, widely doubt that regulators will accept this argument. They argue that the Justice Department (DOJ) is unlikely to view Netflix and YouTube as interchangeable rivals, given their fundamentally different business models, content, and audiences.

Key Differences Between the Services:

• Netflix & HBO Max: Focus on scripted original movies and series (e.g., Stranger Things, KPop Demon Hunters) and charge subscribers a premium monthly fee ranging from $7.99 to $24.99. This content frequently dominates Nielsen’s ranking of most-streamed originals.

• YouTube: Thrives on user-generated content and advertising, featuring music videos, how-to tutorials, and mega-influencers like MrBeast. YouTube commands significantly more viewing time than Netflix or traditional TV, holding 12.9% of streaming viewership compared to Netflix’s projected 9% post-merger share.

Antitrust enforcers are experienced in identifying mergers that reduce competition in distinct sub-markets. Experts cite precedents like the successful FTC challenges against Whole Foods acquiring Wild Oats (reducing competition in “premium natural and organic supermarkets”) and Tapestry acquiring Capri (decreasing competition in the “accessible luxury” market). Unless Netflix’s internal competition analyses demonstrate that the company views YouTube as a major competitor in the same market, the argument could be undermined.

Furthermore, the DOJ is highly skeptical of claims that mergers automatically lead to cost savings passed onto consumers through bundling, and will consider whether the deal allows Netflix to raise prices on standalone subscribers.

Cementing Dominance: The Impact on Global Streaming Markets

If the Netflix-Warner Bros deal finalizes, its impact will be felt globally, creating a formidable market leader, particularly in smaller, competitive regions like the Nordics.

According to Mediavision, Netflix’s planned acquisition, if services are combined, would result in by far the biggest single streaming player in the Nordic region. Currently, over 6 million Nordic households subscribe to either Netflix or HBO Max (or both). By comparison, HBO Max, Disney+, and Viaplay share second place as standalone services, each reaching around 3 million subscribing households. A merged Netflix–HBO Max offer would therefore have roughly twice the household reach of its nearest competitor based on current numbers.

Mediavision principal analyst Fredrik Liljeqvist noted that such a merger would have major consequences for both consumers and the market, creating an “even stronger market leader with a substantial content offering”. However, it remains uncertain whether Netflix and the highly-regarded HBO Max brand will be fully merged in consumer-facing form.

Tech Bytes: Apple’s Brain Drain and McDonald’s AI Ad Flub

Away from the mega-merger, two other key stories demonstrate the pressures facing established tech giants.

Apple’s Leadership Shakeup

Apple is experiencing a critical mass of high-profile departures and retirement announcements in recent weeks. This includes executives leading essential areas such as AI strategy and interface design. The sources report that dozens of staffers have also reportedly left Apple to join competitors, notably OpenAI. This “brain drain” highlights potential competitive challenges for Apple, especially in the fast-moving AI sector.

McDonald’s Pulls AI-Generated Holiday Ad

The promise of artificial intelligence in marketing also saw a public stumble in the fast-food industry. McDonald’s was forced to pull an AI-generated Christmas ad following significant criticism on social media. The incident highlights the risks associated with utilizing emerging technologies like generative AI for public-facing campaigns when consumer reception is uncertain.

——————————————————————————–

Frequently Asked Questions (FAQs) about the Netflix-Warner Bros Deal

Q1: What assets is Netflix acquiring from Warner Bros. Discovery?

Netflix is planning to acquire Warner Bros.’ film and TV studios and streaming assets, which include HBO and HBO Max. The deal follows the spin-off of the Discovery Global networks unit.

Q2: What is the total value of the Netflix acquisition of WBD’s studios and streaming unit?

The winning deal with Netflix is valued at $72 billion. The proposed cash-and-stock transaction for the film and TV studios and streaming assets is valued at $82.7 billion (around €76bn) before the Discovery Global networks unit spin-off.

Q3: Who was the primary rival bidder for Warner Bros. Discovery?

The primary rival bidder was Paramount Skydance, led by David Ellison. Ellison submitted six proposals over 12 weeks, culminating in an all-cash offer of $30 per share for WBD.

Q4: Why did the WBD Board choose Netflix’s lower bid over Paramount’s higher bid?

According to Paramount’s SEC filing, the WBD Board chose the Netflix agreement—which Paramount characterized as a “financially inferior transaction”—despite Paramount’s final $30/share all-cash offer that promised a clearer and faster path to regulatory approval. The WBD Board raised concerns about Paramount’s equity financing structure and the presence of non-U.S. funding sources potentially triggering CFIUS review, although Paramount restructured its final bid to address these concerns.

Q5: Why is the merger facing intense regulatory scrutiny?

The deal represents a massive consolidation in global streaming and premium television, creating a combined entity with 428 million subscribers. Competition authorities in the US and Europe are expected to scrutinize the merger closely to ensure it doesn’t quash competition in distinct sub-markets.

Q6: How is Netflix defending the merger against antitrust concerns?

Netflix argues that the deal is necessary to challenge competitors like Alphabet’s YouTube, asserting that because consumer content consumption is finite, YouTube operates in the same competitive space.

Q7: Why are antitrust experts skeptical of the YouTube rivalry claim?

Antitrust experts believe the Justice Department is unlikely to see YouTube and Netflix/HBO Max as interchangeable rivals because of their fundamentally different content, audiences, and business models. Netflix and HBO Max focus on scripted, premium content delivered through paid subscriptions, while YouTube relies on user-generated content and advertising.

Q8: What is the potential impact of the merger in the Nordic streaming market?

The acquisition could cement Netflix’s streaming dominance in the Nordic region. If combined, the services would have more than 6 million subscribing households, roughly double the household reach of the nearest competitors (HBO Max, Disney+, and Viaplay currently share second place with about 3 million households each).

Q9: What concerns did WBD have regarding Paramount’s financing sources?

WBD expressed concern about the presence of non-U.S. funding sources in Paramount’s equity financing, specifically the sovereign wealth funds from the Middle East. WBD worried these foreign backers might trigger a review by the Committee on Foreign Investment in the United States (CFIUS). Paramount addressed this by ensuring these funds agreed to forgo governance rights, eliminating the CFIUS risk, and removing Tencent as a backer.

Q10: What were the key issues reported about Apple and McDonald’s in recent tech news?

Apple experienced a leadership shakeup with high-profile departures and retirement announcements, including executives leading AI strategy and interface design. Concurrently, McDonald’s pulled an AI-generated Christmas ad after it drew criticism on social media.

——————————————————————————–

The Takeaway

The battle for Warner Bros. Discovery is not just a high-stakes corporate transaction; it is a litmus test for the future of entertainment aggregation. With Netflix poised to control an even larger share of premium scripted content and facing skeptical regulators, the resolution of this merger—and the ensuing hostile takeover attempt—will set precedents for how market power is measured in the age of streaming. This centralization of media stands in sharp contrast to the decentralized shifts seen in the tech industry, where firms like Apple are struggling with executive retention as competition for top talent intensifies in fields like AI.

Which Streaming Giant Matches Your Style?

The $72 Billion Battle: Find Your Platform!

Netflix, Warner Bros., and the Future of Entertainment