Table of Contents

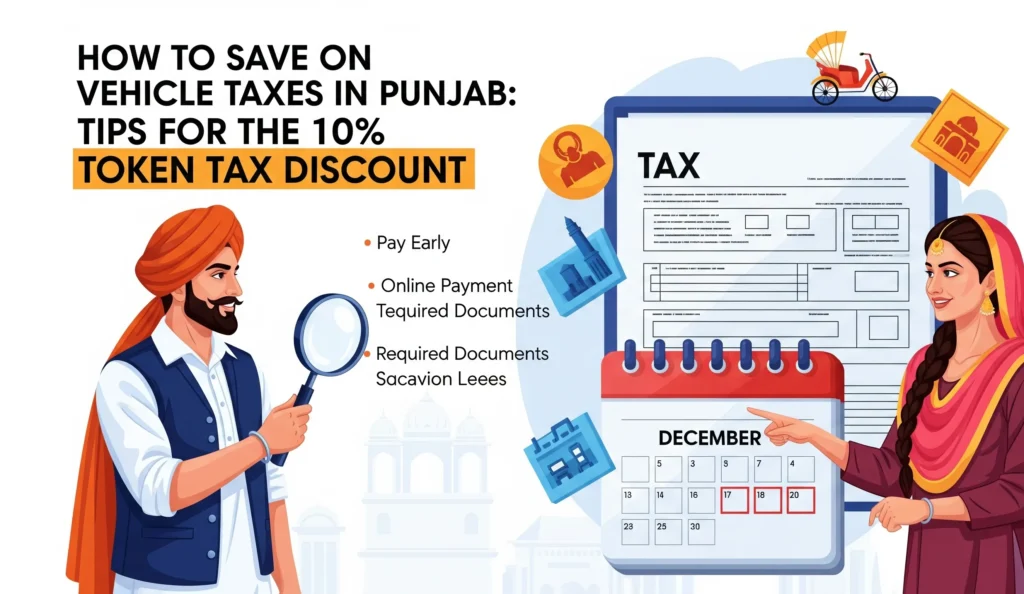

How to Save on Vehicle Taxes in Punjab: Tips for the 10% Token Tax Discount

Date: September 04, 2025

Paying vehicle taxes is never fun, but here’s some good news for car owners in Punjab: the Excise, Taxation & Narcotics Control Department is offering a 10% discount on token tax payments. If you own a car, jeep, or motorcycle registered in Punjab, this guide will show you exactly how to grab this discount and save money.

🚗 Why This Discount Matters

With rising fuel costs, registration fees, and insurance premiums, vehicle ownership in Pakistan keeps getting more expensive. A 10% tax discount may sound small, but for many car owners, it adds up to a significant yearly saving. Plus, paying early helps you avoid penalties.

✅ Who Is Eligible?

The 10% discount is available to:

- Private and commercial vehicle owners registered in Punjab.

- Motorcycles, cars, jeeps, and other registered vehicles.

- Those who pay their annual token tax before the deadline announced by the Punjab government.

📅 Important Deadline

- The discount is typically available on advance token tax payments made before September 30th of the fiscal year.

- Late payments lose eligibility for the 10% discount and may even incur fines.

(Always check the latest circulars from the Punjab Excise Department as dates can vary each year.)

📝 Step-by-Step Guide to Avail the Punjab Token Tax Discount

1. Gather Your Documents

- Original CNIC

- Vehicle registration book/smart card

- Previous year’s paid token tax receipt

2. Choose Your Payment Method

Punjab offers multiple ways to pay:

- E-Pay Punjab App (easy and instant, recommended)

- Online banking apps linked with Punjab Excise

- ATM payments of participating banks

- Excise office counters

3. Calculate Your Token Tax

- Enter your vehicle details (engine capacity, type, etc.) in the ePay Punjab app or Excise website.

- The system automatically shows the tax payable with a 10% discount if you’re eligible.

4. Make the Payment

- Pay online through debit/credit card, bank transfer, or directly via ATM.

- Keep the digital receipt safe for verification.

5. Verify Your Status

- Visit the Excise office if needed, or simply download your updated record from the Punjab Excise website/app.

💡 Pro Tips to Maximize Savings

- Pay early—the sooner, the better. Don’t wait till the last week, as systems often face downtime near deadlines.

- Use the E-Pay Punjab app to skip long lines at Excise offices.

- Keep all receipts (digital or paper) as proof to avoid disputes.

- If you own multiple vehicles, pay for all at once to save time and avoid missing any discount.

❓ FAQs

Q: Is the 10% discount available for all vehicles?

Yes, all registered vehicles in Punjab, including motorcycles and cars, can avail the discount.

Q: Can I pay token tax after September 30 and still get a discount?

No. After the deadline, the discount offer ends and fines may apply.

Q: Can overseas Pakistanis avail this discount?

Yes, as long as the vehicle is registered in Punjab and tax is paid through approved channels, including online portals.

Q: What if my vehicle is registered outside Punjab?

This scheme is only for vehicles registered in Punjab Province.

🎯 Conclusion

The Punjab token tax discount is a simple way to save money while staying compliant with the law. All it takes is paying your vehicle tax early—whether through the E-Pay Punjab app, bank, or Excise office.

👉 Don’t wait until the last minute. Pay your token tax today and grab the 10% discount before the deadline runs out!