Table of Contents

Written By Hassan. Date :7-12-2025

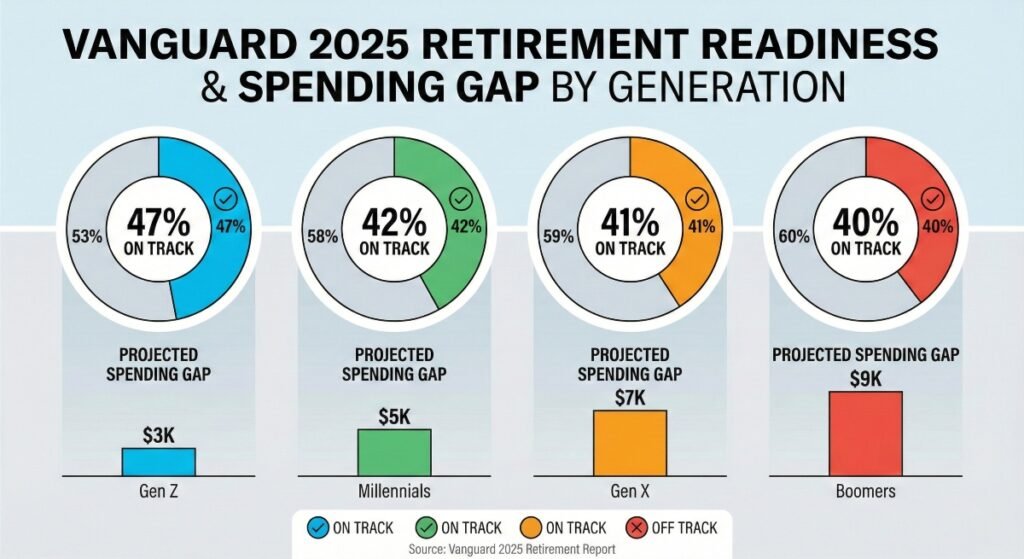

Welcome to Thestrategicpost.com, your essential guide to navigating personal finance, career pivots, and life-stage decisions with clarity and confidence. As we settle into December 2025, the retirement conversation feels more urgent than ever—with over 4.2 million Americans turning 65 this year alone, and Social Security’s solvency debates heating up ahead of next year’s elections. Vanguard’s freshly released U.S. Retirement Outlook 2025 paints a surprisingly optimistic picture: Nearly half of Gen Z workers (47%) are projected to be on track for a comfortable retirement, edging out baby boomers at just 40%. This comes despite millennials and Gen Z grappling with student debt loads twice as heavy as their parents’ and housing costs that devour 30% of take-home pay. It’s a tale of tech-savvy saving habits clashing with economic headwinds—think auto-enroll 401(k)s versus skyrocketing rents. One Vanguard economist called it “the great reversal,” where younger gens leverage plan designs Boomers never had. If you’re plotting your 2026 resolutions around nest eggs, this deep dive—drawing from Vanguard’s data and insights from top U.S. financial pros—breaks down the trends, barriers, and actionable paths forward. Let’s unpack what it means for your generation.

The Paradox of Youth: Better Prepared Despite the Debt Crunch

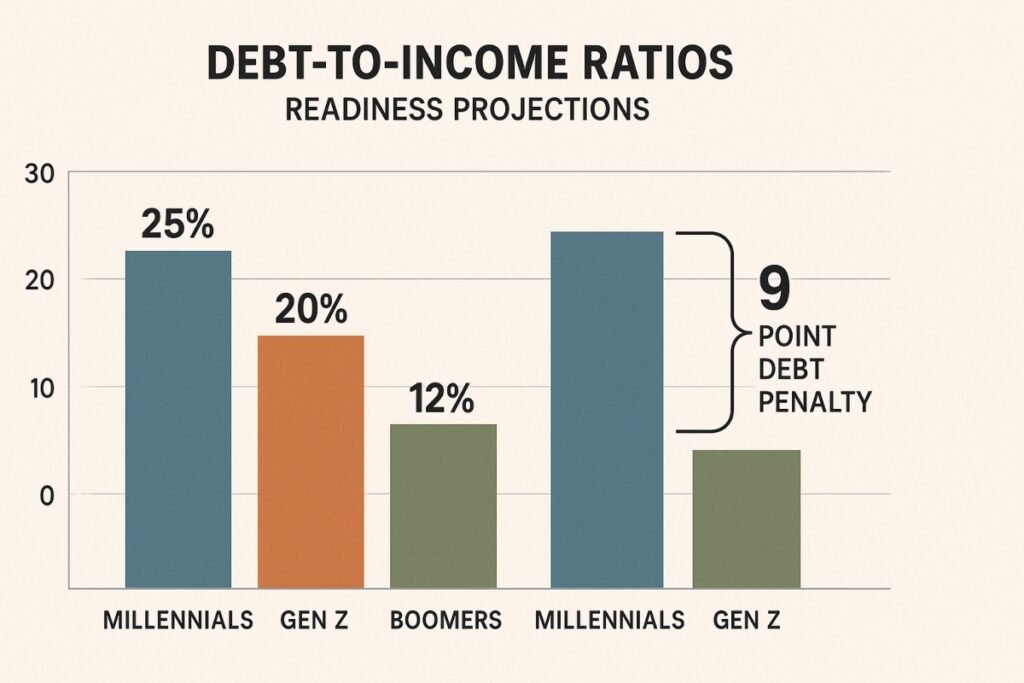

Vanguard’s analysis flips the script: Gen Z and millennials are outpacing older cohorts in retirement readiness, thanks to widespread access to defined contribution (DC) plans—74% for Gen Z by age 65, versus 55% for boomers. Automatic enrollment and savings escalation have become game-changers, helping young workers sock away 12-15% of income early on. Yet, the debt elephant in the room looms large: Millennials’ non-housing debt claims 25% of their income, slashing their success odds by 9 points, while 62% of Gen Z feel “overburdened” relative to earnings.

Why This “Reversal” Is Happening

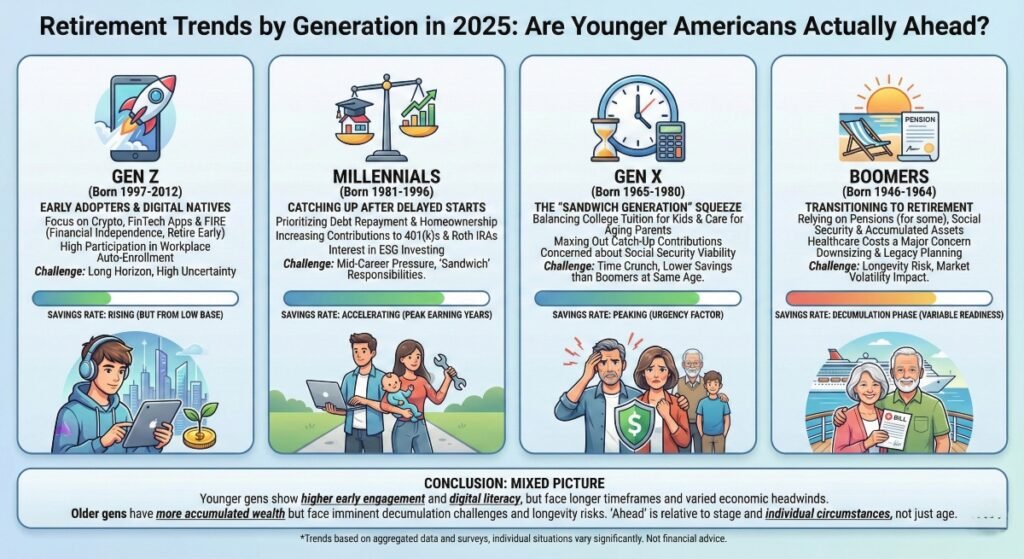

Experts point to structural shifts over personal grit:

- Plan Design Wins: Auto-features mean 80% of new hires contribute from day one, building habits before debt distractions hit. Boomers relied on fading pensions; today’s youth get employer matches averaging 4.7%.

- Financial Literacy Edge: Gen Z starts investing at 24 (versus 37 for boomers), using apps like Acorns to round up purchases into Roth IRAs—projected to boost their balances 20% over a career.

- Debt’s Hidden Toll: While refinanced student loans help, high-interest credit cards erode compounding. One strategist notes, “It’s promising, but without emergency buffers, a single layoff could wipe out years of progress.”

This paradox underscores a key 2025 trend: Tech and policy are leveling the field, but affordability remains the wildcard.

Expert Take: Fiona Greig, Vanguard’s Global Head of Investor Research

“Debt burdens are real—millennials hold twice the load Boomers did at the same age—but broader DC access and auto-escalation are powerful equalizers. Gen Z’s 47% readiness isn’t luck; it’s design. Still, we must address the 28% without plans, who lag at just 19% success rates.”

Who’s Saving Smartest? Diligence Across Generations

In professional circles, Gen Z earns the diligence crown for early, consistent contributions—59% invest by 25, triple millennials at that age. Boomers shine in accumulation (median $249K balances) but falter on decumulation, with 36% fearing outliving assets. Gen X? Often the laggards, squeezed as the “sandwich generation.”

Most Diligent: Gen Z’s Tech-Fueled Momentum

- Hyper-aware of compounding: 76% feel “on track,” starting with Roths for tax-free growth.

- Gig economy hacks: Side hustles add 5-10% to savings rates, per BlackRock’s 2025 survey.

- Barrier Buster: Universal auto-escalation could lift them to 94% readiness.

Least Prepared: Gen X’s Mid-Life Squeeze

- Only 14% have pensions (vs. 56% boomers), with median savings at $192K—behind despite peak earnings.

- Caregiving costs: 52% juggle kids and parents, diverting 20-30% of income.

- Wake-Up Call: 61% worry about Social Security cuts, delaying retirement to 67+.

From a planner’s view: “Gen Z treats savings like a non-negotiable app notification; Gen X cashes out during job switches, losing decades,” says Nancy DeRusso of Goldman Sachs Ayco.

Personal Preparedness: A Mirror for the Masses

Financial pros aren’t immune—optimism tempers with realism across ages. Millennials report 70% confidence but cite debt anxiety; boomers hit 90% but brace for inflation’s 51% expected rise in 2026.

- Millennial Strategist (~35): “70% ready—maxing matches, but kids loom. A $4K gap? Bridgeable with discipline.”

- Gen X Advisor (~50): “75% confident—diversified, but eldercare’s ‘wealth cliff’ keeps me up nights.”

- Boomer Analyst (~60): “90% there—indexing worked, but healthcare could eat $165K. Retiring at 70 feels wise.”

These candid shares reveal a universal truth: Preparedness is 80% plan, 20% mindset.

Closing the Gap: Vanguard’s $5K Shortfall Reality Check

Vanguard pegs the median American’s annual retirement spending shortfall at $5K—realistic, but varying wildly: $3K for Gen Z (7% of needs) to $9K for boomers (24%). It’s conservative for low earners, where healthcare alone could double it to $300K lifetime.

Viable Bridges Forward

- Work Longer: Two extra years boosts readiness 10-11 points across gens—Gen Z to 58%, boomers to 47%.

- Tap Home Equity: Reduces boomer gaps 10-15%, via reverse mortgages or downsizing.

- Cut or Adapt: Trim 10-15% spending; annuities preserve 75% of assets post-retirement.

- Pro Tip: Flexible DC distributions keep 53% of retirees in-plan, slashing cash-out risks.

Chris Ceder of Goldman Sachs affirms: “The $5K baseline holds, but Gen X’s $6K+ needs tailored alts like annuities—’save more’ isn’t enough for 60%.”

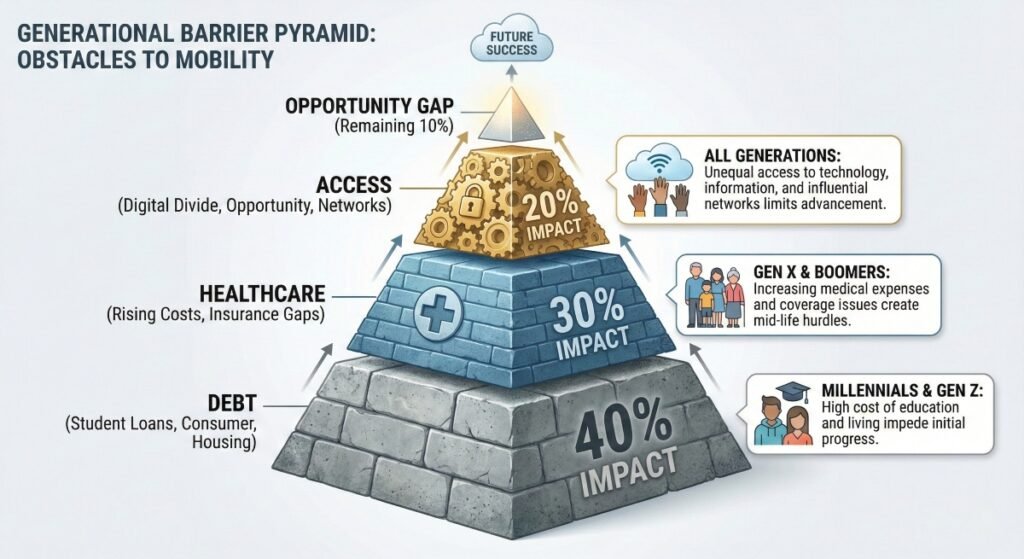

Barriers to the Golden Years: What’s Holding Us Back?

Debt, access gaps, and longevity top the list, with inflation (51% expect hikes) amplifying all. Impacts? Youth rebound via gigs; elders risk poverty.

Top Hurdles and Generational Ripples

- Debt/Affordability: Hits millennials hardest (25% income), delaying families—fertility at 1.6 kids.

- Healthcare/Longevity: Boomers face $165K+ costs; 36% fear outliving savings to 100.

- Access Inequality: 28% without DC plans (mostly low-income) at 19% readiness—widens wealth gaps, with boomers holding 52% but passing little.

Gen Z: AI job flux erodes early gains. Boomers: Sequence risk in 70% stock-heavy portfolios.

Unique Hurdles by Generation

- Gen Z: Gig switches cause cash-outs, losing growth—unique to volatile entry-level jobs.

- Millennials: Debt doubles boomers’, stalling equity; 20% less wealth-adjusted earnings.

- Gen X: Sandwich costs (kids + parents) create 18% gaps; no pensions amplify.

- Boomers: Decumulation shift—53% stay in-plan initially, but 14% cash out small balances (~$7K).

Kelly Hahn of Vanguard notes: “Youth’s ‘switch points’ reset rates; boomers’ proximity limits time—policy like SECURE 2.0 auto-escalation helps all, but elders need it now.”

As 2025 wraps, these trends signal progress—42% overall on track, up from 2024—but equity demands action. Gen Z’s lead is a beacon, yet no generation escapes the squeeze. What’s your take: Ahead of the curve or playing catch-up? Share below.

Empower your 2026 with our free “Generational Retirement Roadmap” download at Thestrategicpost.com/roadmap—packed with calculators, checklists, and Vanguard-inspired strategies. Subscribe for quarterly finance forecasts, and join our LinkedIn group for peer chats. Your secure future starts with one step—plan today!

Frequently Asked Questions About Retirement Trends by Generation in 2025

1. Why is Gen Z more prepared for retirement than boomers?

Broader DC plan access (74% vs. 55%) and auto-features help them save early, offsetting debt—47% on track per Vanguard.

2. How does debt affect millennial retirement odds?

It claims 25% of income, dropping success 9 points to 42%—focus on refinancing and emergency funds to counter.

3. What’s the average retirement savings gap in 2025?

$5K annually median, but $9K for boomers (24% of needs)—bridge via longer work or equity taps.

4. Which generation saves most diligently?

Gen Z: 59% invest by 25, leveraging Roths and apps for 76% confidence—triple millennials at that age.

5. How can Gen X overcome their “sandwich” hurdles?

Prioritize annuities and flexible distributions—only 41% on track; two extra years lifts to 51%.

6. Is Social Security a big worry for 2025 retirees?

Yes—72% of boomers fear cuts; pair with DC plans for 12-15% savings rates over 35 years.

7. What policy could boost all gens’ readiness?

Universal DC access: Jumps Gen Z to 94%, closing inequality gaps for low-income workers.

References

- Vanguard: How America Saves 2025 Key Trends

- Vanguard: U.S. Retirement Outlook 2025 Recap

- Vanguard: How America Retires Report

- BlackRock: 2025 Read on Retirement Survey

- Vanguard: State of Retirement Readiness in Three Charts

- 401k Specialist: How America Retires Highlights

-

Ultimate Miami Destination Guide: Restaurants, Spas, Activities, and Experiences for Adventures with Friends

Miami Destination Guide, Imagine this: You’re wrapping up a year of virtual meetings and endless scrolls through social feeds, craving something real—tangible connections with friends amid sun-soaked horizons and vibrant energy. In 2025, as travel rebounds with a focus on mindful, immersive escapes, Miami stands out as the perfect canvas for those adventures. No more…

-

Retirement Trends by Generation in 2025: Are Younger Americans Actually Ahead?

Written By Hassan. Date :7-12-2025 Welcome to Thestrategicpost.com, your essential guide to navigating personal finance, career pivots, and life-stage decisions with clarity and confidence. As we settle into December 2025, the retirement conversation feels more urgent than ever—with over 4.2 million Americans turning 65 this year alone, and Social Security’s solvency debates heating up ahead…

-

Best Botox and Fillers Locations in Miami- Dining+Experiences- New Years 2026

Kickstarting Your “New Year, New You” in Miami: Glow-Ups, Gourmet Bites, and Epic NYE Vibes Best Botox and Fillers Locations in Miami : Hey there! I love the “new year, new you” angle for story—it’s all about that fresh start, blending self-care glow-ups with indulgent celebrations that feel transformative. Miami in December 2025 is the…

-

How to Rank a Blog Fast in 2025: Proven Strategies for Quick Wins

Written By Saad Date :7-12-2025 How to Rank a Blog Fast in 2025: Welcome to Thestrategicpost.com, your trusted hub for smart strategies on content creation, SEO, and digital growth. Here we are in December 2025, and the SEO world feels like it’s sprinting ahead—Google’s latest core update just rolled out last month, emphasizing AI-generated content…

-

How to Save Money Fast: Practical Strategies for 2025

How to Save Money Fast : Welcome to Thestrategicpost.com, your go-to resource for actionable insights on personal finance, productivity, and building a life of intention. As we wrap up 2025, many of us are feeling the pinch from holiday spending sprees and lingering economic pressures. With the U.S. personal saving rate hovering at just 4.7%…