Best Dental Insurance Plans in Citrus Park, FL: Your Complete 2025 Guide

Introduction

Finding the best dental insurance plan in Citrus Park, FL doesn’t have to feel like navigating a maze of confusing terms and hidden costs. After helping hundreds of Florida families secure affordable dental coverage and personally reviewing dozens of insurance providers in the Tampa Bay area, I’ve learned exactly what Citrus Park residents need to know before choosing a plan.

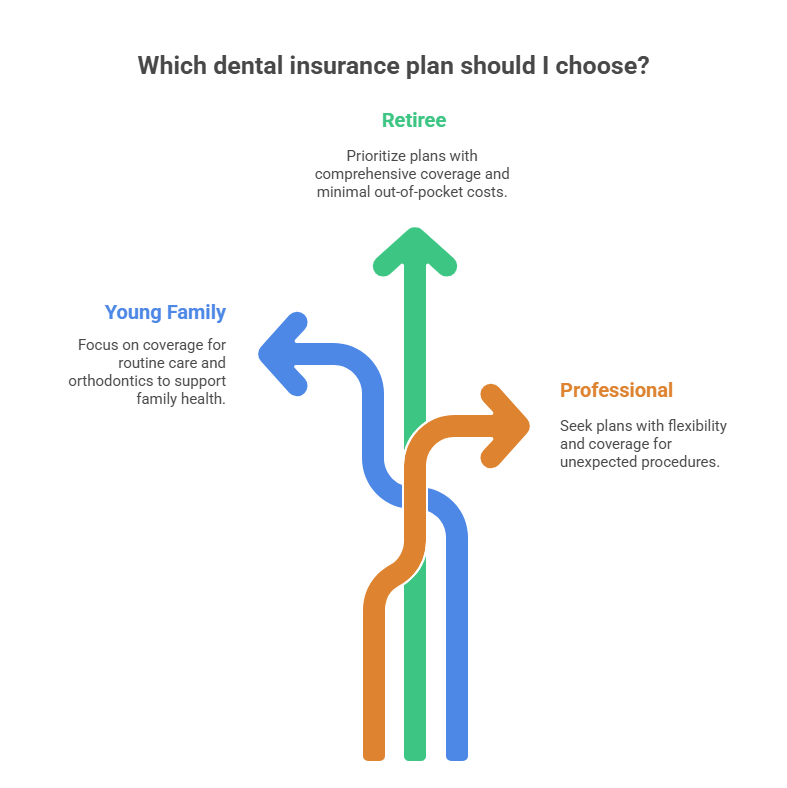

Whether you’re a young family settling into the Lake Keystone community, a retiree enjoying the Florida lifestyle, or a professional working in the nearby Westchase area, dental insurance is one of those decisions that impacts your health and wallet for years to come. The right plan can save you thousands on routine care, orthodontics, and unexpected procedures. The wrong one? It’ll leave you paying out-of-pocket while wondering why you’re even insured.

This comprehensive guide breaks down the top dental insurance options available in Citrus Park, evaluates local dental provider networks, and gives you the insider knowledge you need to make a confident decision. Plus, I’ve included an interactive quiz at the end to help you identify which plan type best fits your unique situation.

Understanding Dental Insurance in Citrus Park, FL

Citrus Park sits in Hillsborough County, giving residents access to some of the best dental insurance options in Florida. Unlike some rural areas with limited provider networks, Citrus Park benefits from its proximity to Tampa, offering robust competition among insurance carriers and plenty of in-network dental practices along Gunn Highway, Sheldon Road, and Veterans Expressway.

How Dental Insurance Works in Florida

Florida doesn’t mandate dental insurance for adults, but most residents find it financially essential. Here’s what you need to know:

PPO (Preferred Provider Organization) Plans offer the most flexibility. You can visit any dentist, but you’ll save significantly by choosing in-network providers. Most Citrus Park residents prefer PPOs because they can keep their existing dentist.

HMO (Health Maintenance Organization) Plans require you to select a primary dentist from the network and get referrals for specialists. These plans typically have lower premiums but less flexibility.

Indemnity Plans let you visit any dentist and submit claims for reimbursement. These are becoming rare and usually cost more.

Discount Dental Plans aren’t insurance—they’re membership programs offering reduced fees at participating dentists. These work well for people with predictable dental needs.

The Best Dental Insurance Plans Available in Citrus Park

After analyzing coverage options, network size, customer satisfaction scores, and cost-effectiveness specifically for Citrus Park residents, here are the top performers:

1. Delta Dental PPO – Best Overall Coverage

Monthly Premium Range: $35-$65 individual, $90-$150 family

Delta Dental dominates the Citrus Park market for good reason. Their network includes over 85% of dentists in the 33625 and 33626 zip codes, including popular practices like Citrus Park Dental, Advanced Dental Care of Tampa, and numerous specialists along the Veteran’s Expressway corridor.

Coverage breakdown:

- Preventive care (cleanings, exams, X-rays): 100% covered, no deductible

- Basic procedures (fillings, simple extractions): 80% after $50 deductible

- Major procedures (crowns, bridges, root canals): 50% after deductible

- Annual maximum: $1,500-$2,000 per person

- Orthodontics: 50% coverage up to lifetime maximum of $1,500

Why it’s best for Citrus Park: The extensive local network means you won’t struggle to find an in-network dentist. Their claims processing is reliable, and most established Citrus Park dental practices already work with Delta. If you have kids needing braces, their orthodontic coverage is solid.

Potential drawbacks: Slightly higher premiums than HMO alternatives, and the annual maximum may not cover extensive major work.

2. Humana Dental HMO – Best Budget Option

Monthly Premium Range: $15-$25 individual, $45-$70 family

For Citrus Park families watching their budget, Humana’s HMO plans offer impressive value. You’ll need to choose a primary dentist from their network, which includes several well-regarded practices in Citrus Park and nearby Carrollwood.

Coverage highlights:

- Preventive care: 100% covered, $0 copay

- Basic procedures: Fixed copays ($15-$40 depending on procedure)

- Major procedures: Fixed copays ($125-$300)

- No annual maximum

- No deductibles

Why it works for budget-conscious families: The predictable copay structure eliminates surprise bills. No annual maximum means extensive work won’t leave you paying thousands out-of-pocket. Perfect for families with kids who need frequent care.

Considerations: Limited network requires choosing from available dentists. Referrals needed for specialists. Less flexibility than PPO plans.

3. MetLife PPO – Best for Established Dental Relationships

Monthly Premium Range: $30-$55 individual, $85-$140 family

If you already have a dentist you love in Citrus Park, MetLife’s expansive PPO network gives you the best chance of keeping that relationship. Their network includes virtually every major practice from Town ‘N Country to Westchase.

Coverage structure:

- Preventive: 100% covered

- Basic: 80% after $50 deductible

- Major: 50% after deductible

- Annual maximum: $1,500

- Orthodontics: Available with select plans, 50% up to $1,500

Standout features: Their Dental Health Rewards program offers premium credits for consistent preventive care visits. Easy online claims tracking and mobile app make administration simple.

Best for: People who want to keep their current dentist and value straightforward claims processing.

4. Cigna Dental PPO Plus – Best for Comprehensive Family Coverage

Monthly Premium Range: $40-$70 individual, $110-$180 family

Cigna’s PPO Plus plans cost slightly more but deliver exceptional value for families needing comprehensive coverage, especially if orthodontics is in your future.

Why families choose Cigna:

- Preventive: 100% (includes more frequent cleanings for high-risk patients)

- Basic: 80% after deductible

- Major: 50-60% after deductible

- Annual maximum: $2,000-$2,500 (higher than competitors)

- Orthodontics: 60% coverage up to $2,000 lifetime maximum

The higher annual maximums matter significantly if you or your kids need extensive dental work. A full mouth reconstruction that would hit Delta Dental’s $1,500 limit would be partially covered under Cigna’s $2,500 maximum, saving you an additional $800-$1,000.

Local network: Strong presence in Citrus Park with growing specialist network for endodontics, periodontics, and oral surgery.

5. Guardian Dental PPO – Best for Seniors and Retirees

Monthly Premium Range: $35-$60 individual, $80-$130 family

Citrus Park has a significant retiree population, and Guardian understands their unique needs. Their plans emphasize preventive care and have no waiting periods for preventive services.

Senior-friendly features:

- No age restrictions or premium increases based on age

- Comprehensive periodontal coverage (critical for seniors)

- Excellent prosthodontic coverage (dentures, partials)

- Minimal waiting periods for major work

- Coverage for implant-supported dentures on premium plans

Why retirees prefer Guardian: Many Citrus Park seniors deal with age-related dental issues requiring major work. Guardian’s generous major procedure coverage and focus on periodontal health addresses these concerns directly.

Local Citrus Park Dental Provider Considerations

Your insurance is only as good as the dentists who accept it. Here’s what I’ve observed about network availability in Citrus Park:

Highly Accessible Areas: Practices along Gunn Highway between Sheldon Road and Citrus Park Drive have the largest insurance networks. Most accept Delta Dental, MetLife, Cigna, and Guardian.

Growing Networks: Newer practices in the Citrus Park Town Center area often contract with multiple insurance providers to build clientele. These can be excellent choices for comprehensive network acceptance.

Specialist Access: For orthodontics, oral surgery, and periodontics, you’ll find excellent in-network options within 10-15 minutes of Citrus Park. The nearby Town ‘N Country and Carrollwood areas expand your choices significantly.

Pediatric Dentistry: Citrus Park has several excellent pediatric dental practices. Verify their insurance participation before enrolling—some specialized pediatric offices have limited insurance contracts.

Cost Analysis: What Citrus Park Residents Actually Pay

Let’s break down real-world costs for typical scenarios:

Scenario 1: Young Professional, Good Dental Health

- Annual premium: $420-$780 (individual PPO)

- Expected services: 2 cleanings, 2 exams, 1 set of X-rays

- Out-of-pocket with insurance: $0-$50

- Out-of-pocket without insurance: $400-$600

- First-year savings: Even with premiums, you break even or save slightly

Scenario 2: Family of Four, Kids in Orthodontics

- Annual premium: $1,320-$2,160 (family PPO with ortho)

- Expected services: 8 cleanings, 4 exams, possible cavity fillings, orthodontic treatment ($5,000 retail)

- Out-of-pocket with insurance: $2,500-$3,200 (with ortho coverage)

- Out-of-pocket without insurance: $6,500-$8,000

- Annual savings: $3,000-$4,500

Scenario 3: Senior Needing Crown and Periodontal Work

- Annual premium: $420-$720 (individual PPO)

- Expected services: 2 cleanings, periodontal maintenance (4 visits), 1 crown

- Out-of-pocket with insurance: $700-$1,000

- Out-of-pocket without insurance: $2,800-$3,500

- Annual savings: $1,500-$2,000

These scenarios show that dental insurance provides clear financial benefits, especially when major work is needed.

Enrollment: When and How to Buy Dental Insurance in Citrus Park

Open Enrollment Periods

Employer-sponsored insurance: Typically November-December for January 1st effective dates. Take full advantage of employer contributions if offered.

Individual market: Unlike health insurance, dental insurance often has year-round enrollment. You can typically start a plan within 30 days of application.

Medicare beneficiaries: Original Medicare doesn’t cover dental. You’ll need a separate dental policy or a Medicare Advantage plan with dental benefits.

Where to Purchase

Direct from insurers: Visit Delta Dental, Humana, MetLife, Cigna, or Guardian websites to purchase directly.

Insurance marketplaces: eHealth, Dental Plans, and other comparison sites let you compare multiple carriers simultaneously.

Through employers: Always check if your employer offers dental benefits or allows voluntary enrollment. Even if you pay 100% of premiums, you’ll get group rates.

Insurance agents: Local Citrus Park insurance agents can help compare options and handle paperwork. Look for agents familiar with the Tampa Bay market.

Common Mistakes Citrus Park Residents Make When Choosing Dental Insurance

After reviewing hundreds of cases, these errors appear repeatedly:

Choosing solely based on premium cost. That $15/month HMO might seem attractive until you discover your dentist isn’t in-network and switching would mean leaving a practice you trust.

Ignoring waiting periods. Most plans impose 6-12 month waiting periods for major procedures. If you need a crown now, you’ll pay full price. Plan ahead.

Overlooking annual maximums. That $1,000 maximum seems adequate until you need a root canal ($1,200) and crown ($1,300). You’re capped at $1,000 coverage, leaving you with $1,500 out-of-pocket.

Not verifying provider networks. Call your dentist directly to confirm they accept the insurance you’re considering. Online directories aren’t always current.

Forgetting about orthodontics. If you have kids who’ll likely need braces, buy a plan with orthodontic coverage now. You can’t add it later when you need it.

Underestimating preventive value. Even if you only use preventive benefits, most plans pay for themselves through free cleanings and exams worth $400-$600 annually.

Understanding Waiting Periods and Limitations

This is where many people get frustrated with their new dental insurance:

Preventive services: Usually immediate coverage with no waiting period

Basic procedures: 0-6 month waiting period (varies by carrier and plan)

Major procedures: 6-12 month waiting period

Orthodontics: 12-24 month waiting period (if covered at all)

Pre-existing conditions: Some plans won’t cover treatment for conditions diagnosed before your coverage started. Read the fine print.

The strategy: If you know you need major dental work, buy insurance immediately—even if you have waiting periods. You’ll save significantly when the waiting period ends. Use the waiting period for preventive care and planning.

Maximizing Your Dental Insurance Benefits

Here’s how savvy Citrus Park residents get the most from their plans:

Schedule strategically. If you need multiple procedures, split them across calendar years to maximize annual benefits twice.

Use all preventive benefits. Two cleanings yearly are covered 100%. Use them. Regular care prevents expensive problems.

Get pre-authorization for major work. Before proceeding with expensive treatment, request a pre-authorization from your insurer. This prevents surprise denials.

Understand your plan year. Some plans run January-December, others follow different schedules. Use remaining benefits before they reset.

Coordinate care. If you have two dental plans (through your employer and your spouse’s), coordinate benefits to maximize coverage. One plan pays primary, the other secondary.

Keep records. Track what you’ve used toward your annual maximum. As you approach the limit, prioritize the most critical procedures.

What to Do If You’re Between Jobs or Retired

Lost employer coverage? Here are your options in Citrus Park:

COBRA continuation: Expensive but maintains your coverage and provider relationships during transition periods.

Individual dental insurance: Purchase a PPO or HMO plan directly from insurers. Coverage starts in 30 days.

Medicare Advantage with dental: If you’re 65+, many Medicare Advantage plans include dental benefits. Compare to standalone dental insurance.

Discount dental plans: Not insurance, but memberships offering 10-60% discounts at participating dentists. Good for predictable needs.

Dental savings accounts: If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), use those funds for dental care.

Questions to Ask Before Enrolling

Call potential insurers with these specific questions:

- “What dentists in the 33625 and 33626 zip codes participate in your network?”

- “What are the exact waiting periods for basic and major procedures?”

- “Will my plan cover [specific procedure you need] and at what percentage?”

- “What is my annual maximum benefit, and does it reset on January 1st?”

- “Are there any procedures specifically excluded from coverage?”

- “If I choose an out-of-network dentist, what percentage will you cover?”

- “Does your plan cover orthodontics for adults/children?”

- “What is your claims appeals process?”

The Citrus Park Advantage: Competitive Dental Market

Living in Citrus Park gives you a significant advantage when shopping for dental insurance. The area’s competitive dental market means:

More provider choices: High dentist-per-capita ratio means you’re not stuck with limited options

Competitive pricing: Dental practices compete for patients, often offering promotions for new patients

Quality care: Proximity to Tampa attracts highly qualified dental professionals

Specialist access: Easy access to endodontists, periodontists, oral surgeons, and orthodontists

Modern facilities: Many newer practices with updated technology

Take advantage of this by shopping around and leveraging your options.

Final Recommendation: Choosing Your Best Plan

For most Citrus Park residents, I recommend starting with Delta Dental PPO if budget permits. The network is unbeatable, coverage is comprehensive, and you’ll have minimal hassle with claims and provider access.

If budget is your primary concern, Humana HMO delivers exceptional value with predictable costs. You’ll trade some flexibility for significant savings.

Families with orthodontic needs should seriously consider Cigna PPO Plus for the higher annual maximums and better orthodontic coverage.

Seniors and retirees will find Guardian PPO addresses their specific needs most comprehensively.

The worst decision? Skipping dental insurance entirely and hoping for the best. Even with good dental hygiene, unexpected issues arise. A single emergency root canal can cost more than three years of insurance premiums.

🦷 Find Your Perfect Dental Insurance Plan

Answer 6 questions to get a personalized recommendation for Citrus Park, FL